1818

The Customs Authority, subjected to the Finance Ministry, is organized based on the French administration system, with special emphasis on its collection role, but without disregard for its role in contraband persecution. Its operation is based on institutions innovative for the time, like the decentralization of Customs Regions and the creation of the legislative framework with the voting of the Customs Code (L. 1165/1918), an important legislative text, which supported customs processes and served commerce.

1830

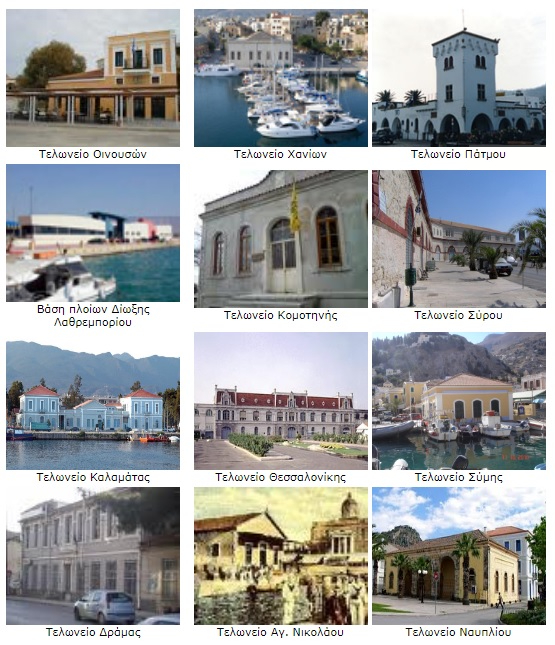

With the creation of the modern Greek State, the first institutions established for the defense of its territorial integrity and securing the required resources for its function, were on the one hand the regular Army the Greek Navy, on the other hand the Customs Authority. On 25/3/1833 the first Customs Office is established on Syros and two years later those of Piraeus, Hydra, Patras and Nauplion. The Customs Authority is therefore perhaps the oldest Administrative Department of the Greek State, which today is subjected to the Ministry of Economics and Finance.

1931

The Customs Authority acquired war ships which, as part of a new Department with the name “Marine Financial Police” (MFP) carried out controls on ships and cargoes as well as the prosecution of illicit trade by sea. Subsequently it acquired more ships with the name “Illicit Trade Prosecution Ships” which were assigned in 2004 to the Port Police to cover the needs of the Olympic Games which took place in the same year in Greece.

1951

The Greek Customs Authority was one of the 13 founding members of the Customs Cooperation Council (now World Customs Organization).

1961

It is a landmark year for the Greek Customs Authority, because the Association Agreement between Greece and the recently established European Economic Community (EEC) is signed. It is worth noting than Greece was the first member which signed an Association Agreement with the EEC. Negotiations end in success and on 28 May 1979 the Act of Accession of Greece to the EEC is signed which enters in force on the 1st January 1981.

1977

The Customs Authority Management on the Headquarters level, which until then co-existed in common General Directorates with the rest of the Tax Management of the Ministry of Finance becomes an independent General Directorate with the title “General Customs Directorate”.

1993

This year which was marked by the unification of the European area, is the most significant event in the history of the Customs Authority. On the 1st November 1993 the Treaty for the European Union entered into force signed in Maastricht. The treaty of Maastricht changed the name of the Community from “European Economic Community” (EEC) to “European Union” (EE).

In the same year, the Customs Authority is assigned the responsibility for assessment and collection of the Excise Duties and the responsibility for monitoring the intra-community circulation and control of products subject to this tax (alcoholic drinks, tobacco products, oil products). So the General Customs Directorate is re-named into “General Customs and Excise Directorate”.

2009

After the profound change brought about in the Customs Authority by the single internal market and the application of the Community Customs Code, today the new Hellenic Customs Code (L. 2960/2001, as amended and in force) is in force, and all necessary amendments are under way for the establishment of the legal framework which will establish an electronic environment for Customs transactions (e-customs).

Currently

The General Customs and Excise Directorate with the individual Customs Directorates, the Special Decentralized and Regional Customs Authorities compose a complex of organic units of the Independent Public Revenue Authority AADE which comprise the “Customs Authority”. The provisions of the Public Servants’ Code also apply to Customs employees, but they wear a uniform and are entitled to carry arms because of their special duties.

They also have the responsibilities and rights of special investigative functionaries regarding the determination of the crimes of illicit commerce, tax evasion or any other customs breach.