Inheritance tax is imposed:

- on any asset located in Greece and owned by residents or non-residents,

- on movable assets located abroad and owned by a Greek,

- on movable assets located abroad and owned by a foreign national who had his residence in Greece.

Taxable is the heir or legatee.

- Calculation of tax

-

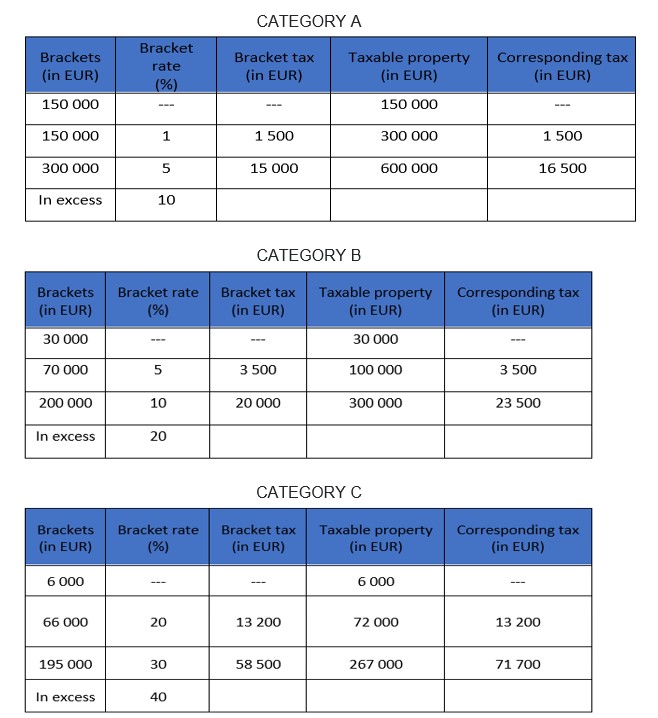

The imposed tax is determined according to the net value of the inherited share and the relation of the inheritor to the testator, based on which the taxpayers are classified into 3 categories. A different tax scale is provided for each category.

The following are classified into category A: a) the spouse or civil partner of the testator; b) the children; c) the grandchildren; and d) the parents of the testator.

The following are classified into category B: a) descendants by blood of the third and following degrees (great grandchildren etc.); b) ascendants by blood of the second and following degrees (grandparents, great grandparents, etc.); c) offspring acknowledged voluntarily or by a court decree with regard to the ascendants of the father who acknowledged them; d) descendants of the child acknowledged with regard to the person who acknowledged them and their ascendants; e) brothers (by whole or half-blood); f) blood relatives of the third degree in a collateral line (nephews and nieces of the testator); g) step-fathers and step-mothers; h) children from a previous marriage of the spouse; i) children-in-law (sons-in-law, daughters-in-law); and j) ascendants-in-law (fathers-in-law, mothers-in-law) of the testator.

Any other relative of the testator by blood or by marriage or any third person is classified into category C.

The following tax bands shall apply:

Where the heir or legatee has a disability of 67% or more, the corresponding tax in accordance with the foregoing shall be reduced by a rate of ten percent (10%).

Tax time is:

- as a rule, the time of death of the testator

- exceptionally, in the cases defined by law (dispute, condition precedent, etc.), the tax time is automatically postponed to a point in time after the death.

An inheritance tax return is submitted:

- by the inheritor or the legatee or his legal representative,

- within nine (9) months, if the testator died in Greece or within one (1) year, if the testator died abroad or the inheritors or legatees were residing abroad at the time of death

- to the Tax Office, to whose territorial jurisdiction belongs the last residential address of the testator. If the testator resided abroad, the declaration is submitted to the Tax Office of Foreign Residents and Alternative Taxation of Tax Residents.

- digitally (Decisions A. 1151/2022, A. 1066/2023, A. 1184/2023 of the IAPR Governor) through the myPROPERTY application of the Single Digital Portal of the Public Administration.The declarations that have not been included in the digital application are submitted in paper form through the “My Requests” application or are sent (in a physical envelope) by registered post or courier service or it can also be filed in an envelope with the protocol office of the competent service (Decision A. 1137/2020 of the IAPR Governor).

Tax return submission begins:

- as a rule, from the death of the testator or

- from the publication of the will, for the testamentary inheritors, or

- from the time the tax liability is incurred, when there is reason for tax deferral.

From the value of the inherited property any debts of the deceased are deducted, proportionately from each share (unless otherwise specified by the testator).

From the inheritance tax arising in Greece for mobile inherited property located abroad, the tax paid abroad for this property, is deducted under certain conditions.

More specific provisions

For assets that are located abroad but are acquired and taxed in the country, provided that, by the last order of the testator, they have been placed in trust under Anglo-American law, the beneficiaries of the monetary amounts that are collected each time are taxed for these amounts immediately, unless otherwise exempted, but those to whom the property ultimately passes are taxed for the full ownership of that property at the time when it passes to them. - Tax exemptions

-

No inheritance tax is due (among others):

- For the acquisitions, provided that the beneficiaries are the State, the accounts in favor of the Treasury and foreign residents with the condition of reciprocity, provided that their tax exemption is provided for by international conventions. It is noted that, in the context of international relations, 4 agreements on the avoidance of double taxation of inheritances with the United States of America have been signed by Greece and are in force (Decree-law 2734/1953 and compulsory law 54/1967), with Spain (law 2423/1920 and law 2850/1954), with Germany (law 4033/1912) and with Italy (Decree-law 140/1974).

- For a monetary deposit in a bank in euros or in a foreign currency in the name of two or more joint beneficiaries, as well as for joint accounts of other domestic or foreign financial products, regardless of the residence of the joint beneficiaries, after the death of any of them. The exemption applies to all surviving co-beneficiaries, to whom the above deposits or accounts automatically accrue and until the last of them. This exemption does not apply to cash deposits or accounts held in non-cooperative states in the tax field.

- For an amount of 400,000 euros per beneficiary, provided that the beneficiaries are the spouse, party of a civil partnership and minor children of the testator, with a corresponding limitation of the steps of the category A’ scale. This exemption is granted to the spouse or member of a civil partnership, provided that the marriage / civil partnership lasted at least 5 years.

- For movable property located abroad and owned by a Greek citizen, who was settled there for at least 10 consecutive years.

- For the acquisition of a first residence due to the death of a spouse, party of a civil partnership, a child of the testator under certain conditions. Beneficiaries of the exemption are Greeks and citizens of member states of the European Union as well as of the countries of the European Economic Area (EEA) who are no longer required (after the entry into force of article 14, Law 4474/2017) to be permanent residents of Greece.

- For the acquisition of a first residence due to the death of a spouse, party of a civil partnership, a child of the testator under certain conditions. Beneficiaries of the exemption are Greeks and citizens of member states of the European Union as well as of the countries of the European Economic Area (EEA) who are no longer required (after the entry into force of article 14, Law 4474/2017) to be permanent residents of Greece.

- Tax payment

-

The tax resulting from the declaration is usually paid in 12 equal bimonthly installments, each of which cannot be less than 500 euros, except for the last one. In the event that the entire amount of the tax is paid in one transaction within the deadline for paying the first installment (provided that it is over 500 euros and the law does not provide for the immediate payment of the tax), a 5% discount is provided.

Inheritance tax matters are regulated by the provisions of the Code on Inheritance, Gifts, Tax, Parental Provision and Profits from Gambling, which has been ratified by the first article of Law 2961/2001, as amended to date and in force and by the provisions of the Tax Procedure Code (v. 4987/2022) as amended to date and in force.