Taxation of Gifts and Parental Provisions

Any asset transferred by gift or parental provision (regardless of whether a notarial document is drawn up) is subject to tax. In particular, gift/parental provision tax is imposed:

- on assets of any kind located in Greece, and gifted,

- on movables located abroad and owned by Greeks and gifted,

- on movables located abroad, owned by a foreigner and gifted to a Greek as well as

- on movables located abroad, owned by a foreigner and gifted to a foreigner residing in Greece.

- Taxpayers

-

The tax is payable by the donee or the recipient of the parental provision, and the amount of tax imposed is determined according to the value of the asset being transferred and the relation of the donee to the provider.

Tax time is:

- as a rule, the time of drawing up the gift contract

- the delivery time of movable property, when it comes to a gift or parental provision of movable assets, for which no document is drawn up.

- exceptionally, in the cases defined by law (dispute, condition precedent, etc.), the tax time is automatically postponed to a point in time after the donation/parental provision.

The declaration of gift/parental provision is submitted

- before drawing up a notarial document,

- in the event of not drawing up a notarial document, within 6 months of the delivery of the object of the gift or parental provision,

- by both parties to the Tax Office of the income tax of the donee/child liable for tax. If the donee or the child lives abroad, the Tax Office of Foreign Residents and Alternative Taxation of Tax Residents is competent.

- digitally (Decisions A. 1249 /2021, A. 1162/2022, Α. 1066/2023 of the IAPR Governor), through the myPROPERTY application of the Single Digital Portal of the Public Administration. The declarations that have not yet been included in the digital application are submitted in paper form through the “My Requests” application or are sent (in a physical envelope) by registered post or courier service or it can also be filed in an envelope with the protocol office of the competent service (Decision A. 1137/2020 of the IAPR Governor).

- Tax exemptions

-

Possessions are exempt from tax, provided that the beneficiaries are:

- the State,

- the accounts in favor of the Treasury, and

- foreigners with the condition of reciprocity, provided that their exemption from the tax is provided for by international conventions.

No gift/parental benefit tax is due (among others):

- For gifts of monetary amounts or other movable assets from anonymous and non-donors, provided that these gifts are organized nationwide in Greece at the initiative of bodies for demonstrably charitable purposes.

- For the financial assistances or compensations paid due to the death of the insured by insurance funds or insurance organizations to the widow, children, parents and unmarried sisters of the testator.

- For the child to acquire a first residence with parental benefits under specific conditions. Beneficiaries of the exemption are Greeks and citizens of member states of the European Union as well as of countries of the European Economic Area (EEA) who are no longer required to be permanent residents of Greece.

- For gifts of movable assets that, at the time of the gift, are abroad, by a Greek citizen who has settled abroad for at least ten (10) consecutive years and, in case of relocation to Greece, no longer than five (5) years, unless the tax authority proves that these were acquired during the last twelve (12) years in the country. For Greek citizens who have settled abroad for at least twenty (20) consecutive years and have not relocated to Greece at the time of the gift, the gifted movable assets that are located abroad at the time of the gift.

This exemption does not include the assets of civil servants, military personnel and employees of companies based in Greece, since these persons settled abroad due to their status as such.

- Calculation of tax

-

Regarding the calculation of the tax, taxpayers are classified into 3 categories based on the relation between the donee and the donor, and a different tax scale is provided for each tax scale (Article 29 of the Code).

The following are classified into category A: a) the spouse or civil partner of the testator; b) the children; c) the grandchildren; and d) the parents of the testator.

The following are classified into category B: a) descendants by blood of the third and following degrees (great grandchildren etc.); b) ascendants by blood of the second and following degrees (grandparents, great grandparents, etc.); c) offspring acknowledged voluntarily or by a court decree with regard to the ascendants of the father who acknowledged them; d) descendants of the child acknowledged with regard to the person who acknowledged them and their ascendants; e) brothers (by whole or half-blood); f) blood relatives of the third degree in a collateral line (nephews and nieces of the testator); g) step-fathers and step-mothers; h) children from a previous marriage of the spouse; i) children-in-law (sons-in-law, daughters-in-law); and j) ascendants-in-law (fathers-in-law, mothers-in-law) of the testator.

Any other relative of the testator by blood or by marriage or any third person is classified into category C.

Parental benefit tax is calculated only for 1st grade descendants (children) and is calculated using the scales of the first category.- Μonetary gifts or parental provisions to beneficiaries of the first category are subject to a 10% flat tax rate. For gifts or parental provision of assets of any kind and the monetary gifts or parental provision to the beneficiaries of the Category A provided that they are carried out (provenly) by transferring money through financial institutions, the tax scale of the first category is applied, which is calculated at the rate of 10%, after deducting a tax-free amount of 800.000 euros.

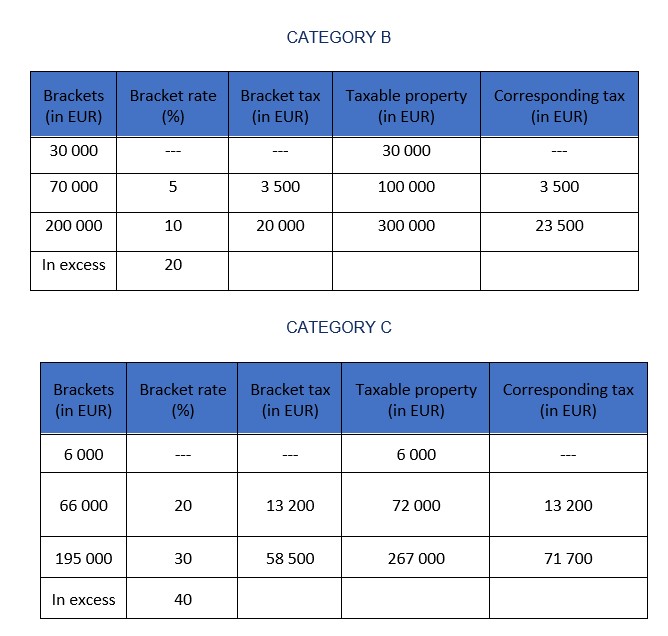

- The donation of money to beneficiaries of the Category B is subject to a 20% flat tax rate whereas the donation of money to beneficiaries of the Category C is subject to a 40% flat tax rate. For all the other assets that are donated to beneficiaries of Category B and Category C the tax is calculated by scales.

The following tax bands shall apply:

Where the heir or legatee has a disability of 67% or more, the corresponding tax in accordance with the foregoing shall be reduced by a rate of ten percent (10%).

- How and when the tax is paid

-

The tax resulting from the declaration is usually paid in 12 equal bimonthly installments, each of which cannot be less than 500 euros, except for the last one.

In the event that the entire amount of the tax is paid in one transaction within the deadline for paying the first installment (provided that it is over 500 euros, and the law does not provide for the immediate payment of the tax), a 5% discount is provided.

In the case of a gift-parental provision of monetary amounts and movables, the tax is paid, as a rule, within three (3) days from the submission of the declaration.

The matters of taxation of gifts – parental provisions are regulated by the Code on Inheritance, Gifts, Tax, Parental Provision and Profits from Gambling, which has been ratified by the first article of Law 2961/2001, as amended to date and in force and by the provisions of the Tax Procedure Code (v. 4987/2022) as amended to date and in force.